How Property Taxes Are Determined

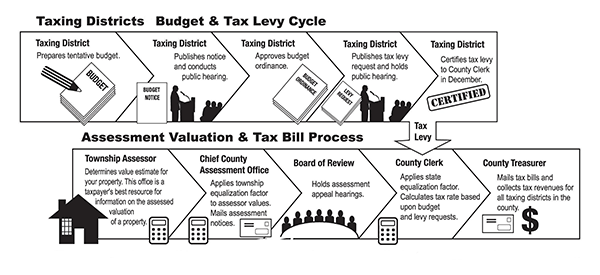

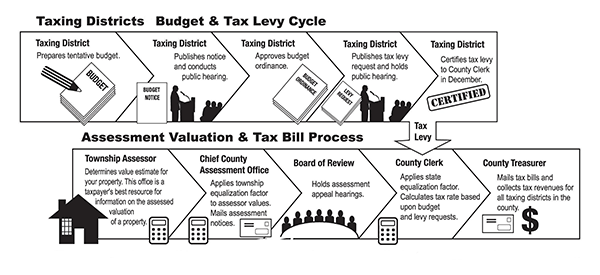

There are two major components of the tax system:

Valuation and Taxation

Valuation: The assessment office establishes the full market value of the properties in the township. The assessment is one-third of full market value per Illinois Statutes.

Taxation: Taxes are the result of the monies needed to operate each unit of government shown on your tax bill (county, cities, township, school districts, fire protection districts, library districts, etc.). These units of government levy their needed monies by certification to the County Clerk toward the end of each calendar year. These levy amounts are converted to a tax rate based on the amount of taxable assessed value within the respective taxing district.

Tax rate formula: The levy is extended into a tax rate by the following formula:

- Equalized Assessed Value (EAV) minus Exemptions = Taxable EAV

- Levy amount divided by Taxable EAV = Tax Rate

People accepted increasing property values and taxes when the market was good. As the real estate market shows a decrease it would be logical to think taxes would decrease as well. This is not necessarily true. The taxes will not decrease until the levy amounts decrease as well. It is true that an assessment reduction does not necessarily equate to a reduction of the real estate taxes unless the respective units of government reduce the amount of monies needed to operate.